Introduction

Bitcoin has evolved from a mysterious digital currency to one of the most valuable assets in the world. From its humble beginnings in 2010, when its value was only a few cents, to its projected worth in 2025, Bitcoin has witnessed an extraordinary transformation.

Understanding Bitcoin Price USD in 2010 & 2025 provides insight into how this digital asset has grown and what the future holds. In this article, we will explore Bitcoin’s price history, the factors influencing its growth, and expert predictions for 2025.

Bitcoin Price in 2010 – The Beginning of a Revolution

Bitcoin was first introduced by an anonymous entity known as Satoshi Nakamoto in 2009. However, it wasn’t until 2010 that Bitcoin started to have a real-world price.

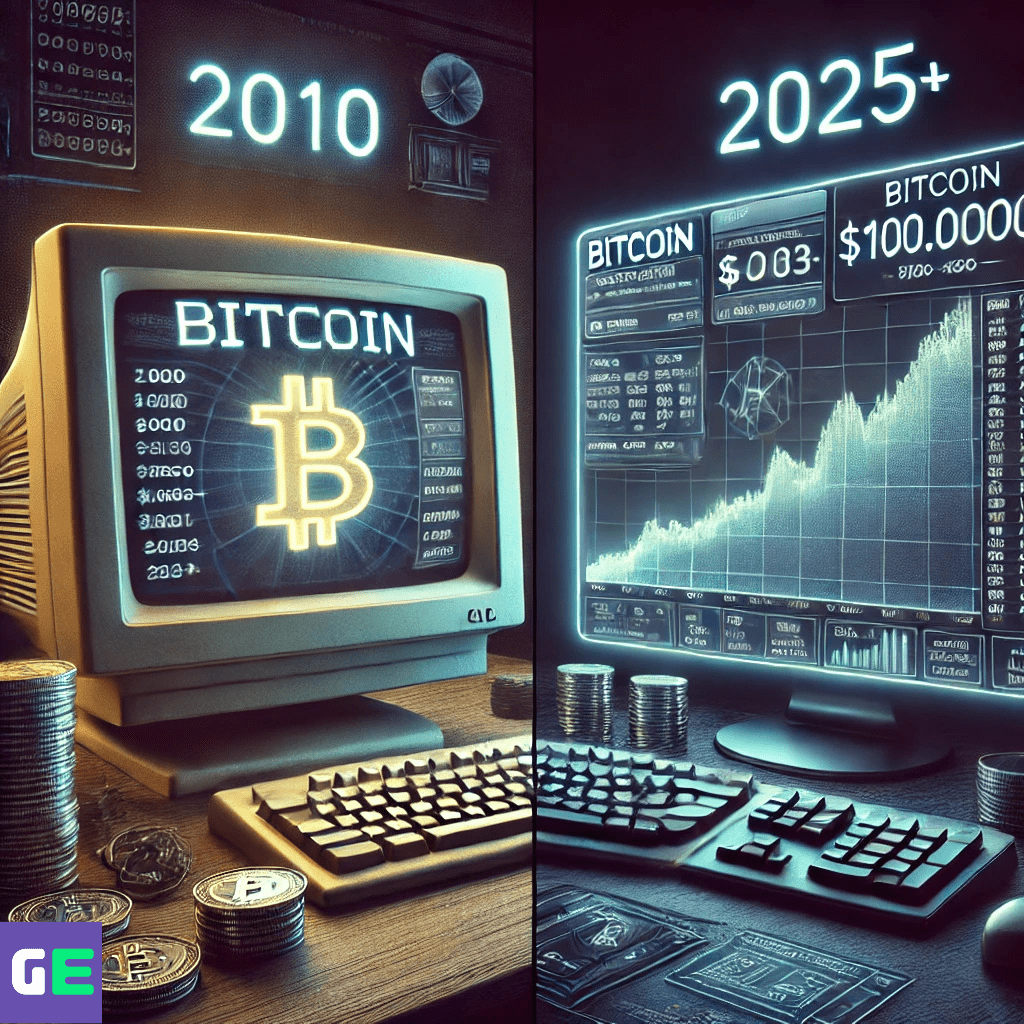

- Bitcoin Price USD in 2010: At the beginning of 2010, Bitcoin had no significant value. The first recorded price was around $0.003 per BTC.

- First Bitcoin Transaction: On May 22, 2010, Laszlo Hanyecz made history by purchasing two pizzas for 10,000 BTC (worth just $41 at that time). Today, those bitcoins would be worth hundreds of millions of dollars.

- Bitcoin’s Early Trading: By July 2010, Bitcoin was trading at $0.08 per BTC. By the end of the year, Bitcoin had reached $0.30 per BTC, showing early signs of growth.

Despite being in its infancy, Bitcoin attracted tech enthusiasts and early adopters who saw its potential.

Factors That Drove Bitcoin’s Early Growth

The rise of Bitcoin Price USD in 2010 was fueled by several key factors:

1. Decentralization and Innovation

Bitcoin was the first cryptocurrency to operate without a central authority, which intrigued early adopters. The blockchain technology behind it was revolutionary.

2. Mining and Supply Limit

Unlike traditional currencies, Bitcoin had a maximum supply of 21 million coins, creating scarcity that would later drive its value higher.

3. Increasing Public Interest

As Bitcoin started gaining traction on forums like Bitcointalk and social media, more people became interested in mining and trading it.

4. Media Attention

Although mainstream media did not cover Bitcoin extensively in 2010, niche tech blogs and forums discussed its potential, contributing to its slow but steady rise.

Despite these positive developments, Bitcoin was still considered an experimental asset with little real-world use.

Bitcoin’s Price Journey Over the Years

Bitcoin’s price didn’t remain low for long. Here are some significant milestones:

- 2011: Bitcoin crossed $1 for the first time in February and peaked at $31 in June, before crashing to $2.

- 2013: Bitcoin hit $1,000 for the first time before facing another crash.

- 2017: Bitcoin reached $20,000, marking its first major bull run.

- 2021: Bitcoin achieved a new all-time high of $69,000.

- 2022-2023: Bitcoin experienced a bear market, but began recovering in 2024.

Each milestone was accompanied by events such as government regulations, adoption by institutional investors, and Bitcoin halving events.

Bitcoin Price in 2025 – Predictions and Expectations

As Bitcoin continues to gain mainstream adoption, experts have made several predictions for Bitcoin Price USD in 2025:

1. Institutional Adoption and ETFs

With large institutions like BlackRock and Fidelity investing in Bitcoin, demand is expected to rise significantly. Bitcoin ETFs (Exchange-Traded Funds) make it easier for traditional investors to participate in the crypto market.

2. Bitcoin Halving in 2024

Bitcoin’s next halving event in April 2024 will reduce the mining reward from 6.25 BTC to 3.125 BTC per block. Historically, halving events have led to massive price increases due to reduced supply.

3. Predictions by Experts

- Some analysts predict Bitcoin will reach $100,000 to $250,000 by 2025.

- Optimistic forecasts suggest it could even hit $500,000 if adoption continues to grow rapidly.

4. Government Regulations and Policies

Countries are beginning to embrace Bitcoin, while some governments are exploring Central Bank Digital Currencies (CBDCs). More regulation could either boost Bitcoin’s legitimacy or pose challenges.

5. Bitcoin’s Role as Digital Gold

Many investors now see Bitcoin as a hedge against inflation, similar to gold. This perspective could drive its price even higher in the coming years.

Comparing Bitcoin’s Value: 2010 vs. 2025

The difference between Bitcoin Price USD in 2010 & 2025 is nothing short of extraordinary.

Key Comparisons:

| Year | Bitcoin Price (USD) | Key Events |

|---|---|---|

| 2010 | $0.003 – $0.30 | First Bitcoin transaction, early mining |

| 2025 (Prediction) | $100,000 – $500,000 | Institutional adoption, post-halving price surge |

Bitcoin’s transformation from a niche technology to a trillion-dollar asset showcases its immense potential.

The Future of Bitcoin Beyond 2025

What lies ahead for Bitcoin after 2025?

1. Will Bitcoin Continue to Rise?

Given its limited supply and increasing adoption, Bitcoin is expected to retain its value, with many experts believing it could surpass $1 million in the long run.

2. Technological Advancements

- Lightning Network: Enables faster and cheaper Bitcoin transactions.

- Layer 2 Solutions: Improve scalability and usability.

- Smart Contracts on Bitcoin: Some projects aim to bring smart contract functionality to Bitcoin.

3. Bitcoin as a Global Reserve Asset

If countries continue to adopt Bitcoin as a legal tender (as seen in El Salvador), it could become a global reserve currency in the future.

Conclusion

The story of Bitcoin Price USD in 2010 & 2025 is a testament to how revolutionary technology can disrupt traditional financial systems. From being worth just a few cents in 2010 to predictions of $100,000+ in 2025, Bitcoin has established itself as a dominant asset in the digital age.

While Bitcoin’s future remains uncertain, its past growth suggests that it will continue to play a significant role in the financial world. Whether you’re an investor, a trader, or simply an observer, keeping an eye on Bitcoin’s journey is essential.

For more insights into Bitcoin price trends and predictions, check out CoinMarketCap’s Bitcoin Price Data.

FAQs

1. What Was Bitcoin Price USD in 2010?

Bitcoin was virtually worthless in early 2010. The first recorded Bitcoin Price USD in 2010 was around $0.003 per BTC. In July 2010, Bitcoin’s value increased to $0.08 per BTC, and by December, it reached $0.30 per BTC. Despite its low value, this marked the beginning of Bitcoin’s remarkable journey.

2. How Did Bitcoin Price USD in 2010 Compare to Other Currencies?

In 2010, Bitcoin had almost no value compared to traditional currencies. For example, 1 Bitcoin was worth less than a penny, making it practically useless for transactions. However, as more people recognized its potential, the Bitcoin Price USD in 2010 started rising, eventually paving the way for its dominance in 2025.

3. Why Was Bitcoin So Cheap in 2010?

The Bitcoin Price USD in 2010 remained low because very few people understood its significance. It was an experimental technology without widespread adoption, and most investors were skeptical. Additionally, mining was easy, allowing early adopters to accumulate large amounts of Bitcoin at almost no cost.

4. What Influenced Bitcoin Price USD in 2010?

Several factors shaped Bitcoin Price USD in 2010, including:

- Lack of awareness – Bitcoin was mostly known within tech circles.

- No real-world use cases – Very few businesses accepted Bitcoin.

- Low demand – Only a handful of investors believed in Bitcoin’s future.

- High mining rewards – Miners could easily earn Bitcoin, keeping prices low.

Despite these challenges, the Bitcoin Price USD in 2010 showed early signs of potential growth.

5. What Is Bitcoin Price in USD in 2025?

Predictions for Bitcoin Price USD in 2025 vary, but most experts believe Bitcoin could range between $100,000 and $500,000. Some bullish analysts even suggest it could surpass $1 million per BTC due to factors like institutional adoption, Bitcoin halving, and mainstream acceptance.

6. How Did Bitcoin Reach Its 2025 Price?

The Bitcoin Price USD in 2025 is influenced by several key factors:

- Bitcoin’s fixed supply of 21 million coins

- Growing institutional investment in Bitcoin ETFs

- Widespread adoption by businesses and governments

- The 2024 Bitcoin halving event, reduced the supply of new BTC

These elements contribute to a steady increase in Bitcoin Price USD in 2025, making it a highly valuable asset.

7. What Was the Percentage Increase in Bitcoin Price USD from 2010 to 2025?

The growth of Bitcoin Price USD in 2010 & 2025 is extraordinary. If Bitcoin reaches $100,000 in 2025, this represents an increase of over 33,000,000% from its price of $0.30 in 2010. If Bitcoin hits $500,000, the percentage increase would be even higher.

8. What Events Impacted Bitcoin Price USD in 2010 & 2025?

Major events influencing Bitcoin Price USD in 2010 & 2025 include:

- 2010: The first Bitcoin transaction (10,000 BTC for two pizzas).

- 2011-2013: Early price surges and market crashes.

- 2017: Bitcoin’s first bull run to $20,000.

- 2021: Bitcoin reached an all-time high of $69,000.

- 2024-2025: Bitcoin halving and institutional adoption push prices higher.

9. Is Bitcoin Still a Good Investment in 2025?

The Bitcoin Price USD in 2025 suggests that Bitcoin remains a strong investment option. Many investors consider Bitcoin “digital gold” due to its scarcity. However, Bitcoin’s volatility means investors should carefully research before making financial decisions.

10. Will Bitcoin Price USD in 2025 Be Stable?

Bitcoin’s price is known for its volatility. While Bitcoin Price USD in 2025 might reach new highs, market fluctuations will still occur. Factors such as regulation, economic conditions, and technological advancements will influence stability.

11. How Does Bitcoin Halving Affect Bitcoin Price USD in 2025?

Bitcoin halving events reduce the mining reward by half, decreasing the supply of new Bitcoin. The 2024 halving is expected to significantly impact Bitcoin Price USD in 2025, potentially driving it higher due to reduced availability and increasing demand.

12. How Many People Owned Bitcoin in 2010 vs. 2025?

In 2010, only a few thousand people owned Bitcoin. By 2025, millions of people and institutions are expected to hold Bitcoin, further driving up Bitcoin Price USD in 2025. The rise in global adoption is one of the key reasons why Bitcoin continues to gain value.

13. Can Bitcoin Still Drop Below $10,000 in 2025?

While anything is possible, most experts believe Bitcoin Price USD in 2025 will not fall below $10,000 due to increasing adoption and institutional support. However, regulatory actions or market crashes could still cause temporary price dips.

14. What Are the Best Strategies for Investing in Bitcoin Price USD in 2025?

For those looking to invest in Bitcoin Price USD in 2025, some key strategies include:

- Dollar-cost averaging (DCA): Buying Bitcoin gradually over time.

- Holding (HODLing): Holding Bitcoin for long-term gains.

- Diversification: Investing in other cryptocurrencies alongside Bitcoin.

15. Where Can I Check Real-Time Bitcoin Price USD in 2010 & 2025?

To monitor Bitcoin prices, check live data on platforms like CoinMarketCap or CoinGecko. These platforms provide historical data on Bitcoin Price USD in 2010 & 2025, helping investors make informed decisions.

16. How many Bitcoins were in circulation in 2010 compared to 2025?

In 2010, Bitcoin was still in its early mining phase, and only about 2-3 million BTC were in circulation. By 2025, the circulating supply will be close to 20 million BTC, with only about 1 million BTC left to be mined before reaching the 21 million supply cap.

The scarcity of Bitcoin over time is one of the major reasons why its price has increased significantly since 2010 and is expected to rise further by 2025.

17. What major events influenced Bitcoin’s price from 2010 to 2025?

Several key events have shaped Bitcoin’s price over the years, including:

- 2010: First Bitcoin transaction (10,000 BTC for two pizzas)

- 2011: Bitcoin surpassed $1 for the first time

- 2013: Bitcoin hit $1,000 for the first time

- 2017: Bitcoin reached $20,000, driven by retail hype

- 2020: Institutional adoption increased, and Bitcoin surpassed $30,000

- 2021: Bitcoin reached an all-time high of $69,000

- 2024: Bitcoin halving (reducing supply) – expected to drive prices higher in 2025

Each of these milestones played a role in shaping Bitcoin’s price, and similar events will continue to impact it in the future.

18. Will Bitcoin face more government regulations by 2025?

Yes, as Bitcoin adoption grows, governments worldwide are increasingly focusing on regulations. By 2025, we can expect:

- More taxation policies on Bitcoin profits

- Stronger regulations on exchanges and crypto wallets

- Possible government-backed digital currencies (CBDCs) competing with Bitcoin

While regulations may impact short-term price movements, they could also bring more legitimacy to Bitcoin, encouraging institutional investors to enter the market.

19. How does Bitcoin compare to other investments like stocks and gold?

Bitcoin has outperformed stocks, gold, and real estate in terms of returns over the last decade. Here’s how it compares:

| Investment | Avg. Annual Return | Risk Level | Liquidity |

|---|---|---|---|

| Bitcoin | ~150% (since 2010) | High | High |

| Stock Market (S&P 500) | ~10% | Medium | High |

| Gold | ~6% | Low | High |

| Real Estate | ~5-8% | Medium | Low |

While Bitcoin is highly volatile, it has delivered the highest returns compared to traditional investments, making it an attractive long-term asset.

20. Is it too late to invest in Bitcoin in 2025?

No, many experts believe that Bitcoin still has significant growth potential beyond 2025. Here’s why:

- Scarcity: With over 90% of Bitcoin already mined, demand will continue to rise.

- Institutional Adoption: More financial institutions and governments are adopting Bitcoin.

- Halving Effect: Historically, Bitcoin sees major price surges 12-18 months after a halving event, meaning 2025 could be another bull run.

- Global Inflation: As fiat currencies lose value, Bitcoin serves as a hedge against inflation.

Even though Bitcoin is already expensive compared to its 2010 price, experts predict long-term growth, making it a valuable investment opportunity in 2025 and beyond.

Leave a Reply