Introduction

Building a strong credit score is more important than ever in 2025. Whether you’re looking to buy a home, finance a car, or secure a business loan, your credit history is crucial in determining your financial future. Understanding how to build credit from scratch or improve an existing score can help you secure better interest rates, qualify for larger loans, and even improve job opportunities.

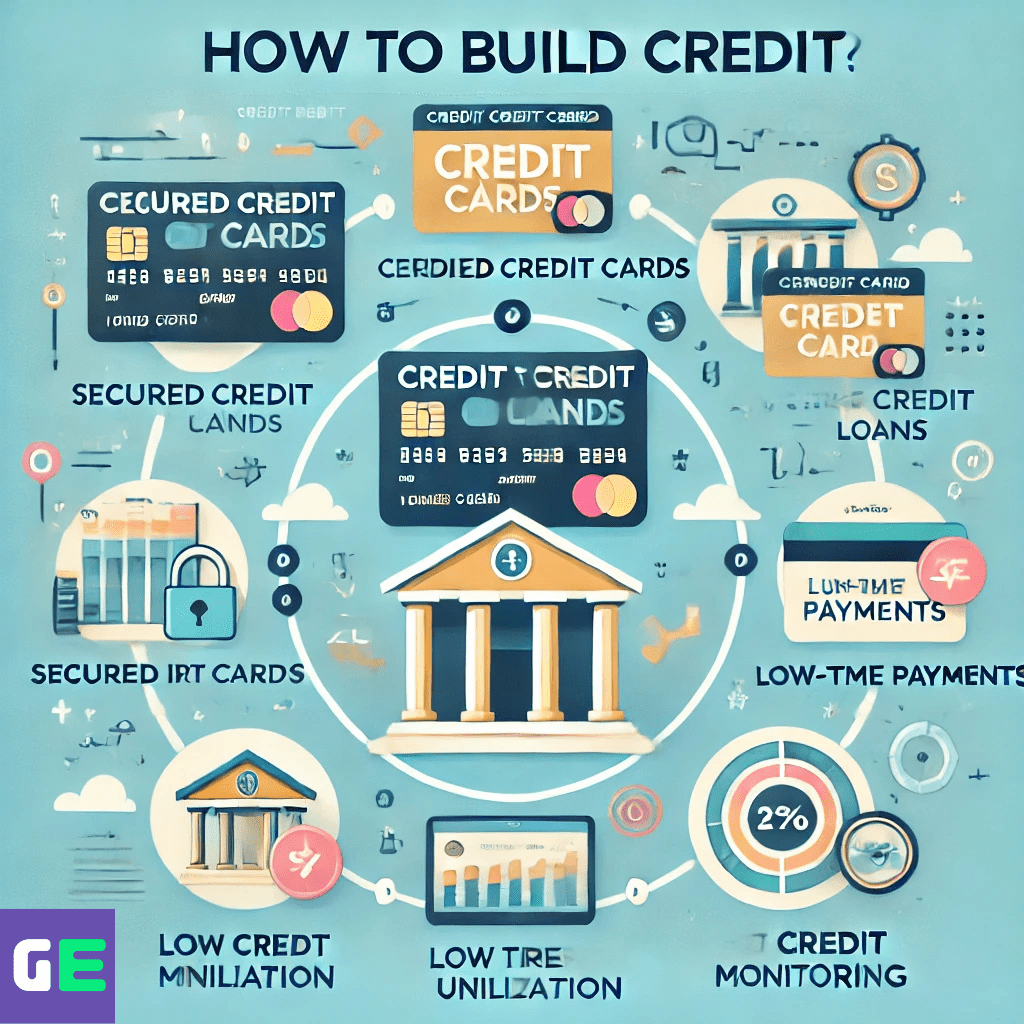

In this guide, we will explore how to build credit effectively and ensure financial stability for the long term. By following these steps, you can create a solid foundation that leads to financial success.

1. Understanding Credit: Why It Matters

Before diving into how to build credit, it’s important to understand what credit is and why it matters. Your credit score is a numerical representation of your financial trustworthiness. Lenders, landlords, and even some employers use your credit score to assess your reliability in handling financial obligations.

What Determines Your Credit Score?

Credit scores are typically calculated using the FICO Score or VantageScore, both of which consider the following factors:

- Payment history (35%) – Whether you pay bills on time.

- Credit utilization (30%) – The percentage of available credit you’re using.

- Credit history length (15%) – How long you’ve had credit accounts.

- Credit mix (10%) – The variety of credit accounts (loans, credit cards, etc.).

- New credit inquiries (10%) – The number of times you apply for new credit.

Understanding these factors is key to how to build credit effectively and maintain a high score.

2. How to Build Credit From Scratch

If you have no credit history, it may seem challenging to get started. However, several options can help you establish credit.

Open a Secured Credit Card

A secured credit card is one of the easiest ways to start building credit. Unlike regular credit cards, a secured credit card requires a cash deposit as collateral. The issuer reports your usage to the credit bureaus, helping you build credit with responsible use.

Take Out a Credit-Builder Loan

Credit-builder loans are designed specifically to help people establish credit. The lender holds the borrowed money in a savings account while you make fixed payments over time. Once the loan is fully paid, you receive the money, and your on-time payments build positive credit history.

Become an Authorized User

If you have a trusted family member or friend with good credit, you can ask them to add you as an authorized user on their credit card. This allows you to benefit from their positive credit history, helping you build your score.

3. Smart Credit Card Usage to Build Credit

If you already have a credit card or plan to get one, managing it wisely is crucial to how to build credit successfully.

Pay Your Bills on Time

Your payment history is the most significant factor in your credit score. Missing even one payment can negatively impact your credit. Setting up automatic payments or reminders can help ensure you never miss a due date.

Keep Your Credit Utilization Low

Credit utilization refers to the amount of credit you use compared to your total limit. Experts recommend keeping utilization below 30% to avoid damaging your score. For example, if you have a $1,000 credit limit, try not to use more than $300 at any given time.

Avoid Applying for Too Many Cards

Each time you apply for new credit, a hard inquiry is added to your credit report, which can lower your score. Applying for multiple credit cards within a short period can make you appear risky to lenders.

4. How to Build Credit Without a Credit Card

Not everyone wants to rely on credit cards. Luckily, there are alternative ways to build credit without one.

Report Rent and Utility Payments

Traditionally, rent and utility payments don’t contribute to your credit score, but services like Experian Boost and Rental Kharma allow you to report these payments to credit bureaus.

Take Advantage of Experian Boost

Experian Boost is a free service that lets you add phone, utility, and even streaming service payments to your Experian credit report. This can instantly help build credit by reflecting positive payment history.

5. Monitoring and Improving Your Credit Score

Monitoring your credit regularly ensures no errors or fraudulent activities are affecting your score. There are free and paid credit monitoring services available, such as:

- Credit Karma (free)

- Experian CreditWorks (free and paid options)

- MyFICO (paid, with detailed reports)

If you find inaccuracies on your credit report, you have the right to dispute them with the credit bureaus.

6. Avoiding Common Credit Mistakes

Don’t Max Out Your Credit Cards

Using too much of your available credit can lower your score. Even if you pay off your balance every month, high utilization can be a red flag to lenders.

Don’t Close Old Accounts

The length of your credit history impacts your score. Closing old credit cards can reduce your overall credit age, potentially lowering your score.

Don’t Co-Sign Loans Without Caution

Co-signing a loan means you’re responsible if the primary borrower defaults. If they miss payments, it will negatively impact your credit score.

7. How to Build Credit for Major Financial Goals

A high credit score is essential for achieving major financial milestones like buying a home or car. Here’s how to prepare:

Mortgage and Home Loans

Most lenders require a credit score of 620 or higher for a mortgage. However, higher scores (above 740) qualify for better interest rates.

Auto Loans

A strong credit score can help secure lower interest rates on car loans, potentially saving you thousands over the life of the loan.

Business Loans

If you plan to start a business, lenders will evaluate your credit history. Good credit can increase approval chances and lower loan costs.

8. How to Maintain Good Credit for Life

Budget Wisely

Creating a budget helps ensure you can pay all your bills on time, preventing missed payments that could damage your score.

Avoid Unnecessary Debt

Only take on debt that you can manage. Borrowing more than you can afford can lead to financial stress and a lower credit score.

Continue Monitoring Your Credit

Even after achieving a high score, it’s important to monitor your credit report regularly to maintain good standing.

Conclusion

Understanding how to build credit is essential for financial success. Whether you’re starting from scratch or trying to improve your score, following these steps will help you achieve your financial goals. A strong credit score not only gives you access to better loans and lower interest rates but also sets the foundation for a secure financial future. Start today and take control of your financial destiny! Read more

FAQs

1. What Is the Fastest Way to Build Credit From Scratch?

The fastest way to build credit includes getting a secured credit card, becoming an authorized user on a trusted account, taking out a credit-builder loan, and ensuring on-time payments while keeping credit utilization low.

2. How to Build Credit Without a Credit Card?

You can build credit without a credit card by reporting rent payments through services like RentTrack, using Experian Boost to add utility bills to your credit report, and taking out credit-builder loans or secured loans from credit unions.

3. How Long Does It Take to Build Credit?

Building credit from scratch typically takes three to six months to generate a credit score, but achieving a good credit score (700+) can take a year or more, depending on responsible financial habits.

4. Does Paying Bills Help Build Credit?

Yes, some bills like rent, utilities, and phone payments can help build credit if reported to credit bureaus. Services like Experian Boost, LevelCredit, and RentReporters allow you to add these payments to your credit history.

5. How to Build Credit at 18?

If you’re 18, you can start building credit by getting a student credit card, becoming an authorized user on a parent’s credit card, applying for a credit-builder loan, and opening a secured credit card while making on-time payments.

6. How Does a Secured Credit Card Help Build Credit?

A secured credit card requires a refundable deposit as collateral. When used responsibly, it reports positive payment history to credit bureaus, helping you establish and improve your credit score.

7. How Many Credit Cards Should I Have to Build Credit?

Having one to three credit cards is ideal for building credit. Too many applications in a short time can lower your score, but having multiple accounts with good payment history and low utilization can improve your credit over time.

8. Does Checking My Credit Score Hurt My Credit?

No, checking your credit score through services like Credit Karma, Experian, or your bank is a soft inquiry and does not affect your credit score. However, hard inquiries (from applying for credit) can lower your score temporarily.

9. Can I Build Credit With a Debit Card?

No, using a debit card does not build credit because it does not involve borrowing money. However, some banks offer credit-building debit programs where purchases are reported as credit transactions.

10. What Is the Best Credit Score to Aim for?

A credit score of 700+ is considered good, while 750+ is excellent. The higher your score, the better interest rates and financial opportunities you’ll have.

11. Can I Build Credit by Paying Rent?

Yes, you can build credit by paying rent if your landlord reports payments to the credit bureaus or if you use third-party services like Experian RentBureau, RentTrack, or LevelCredit. These services help renters improve their credit scores by adding rent payment history to their credit reports.

12. What Happens If I Don’t Build Credit?

If you don’t build credit, you may face difficulties getting approved for loans, credit cards, mortgages, or even rental agreements. Additionally, without a credit history, you might have to pay higher interest rates or provide larger security deposits for services like utilities and cell phone plans. Learning how to build credit early can save you money and provide better financial opportunities.

13. Does Opening a Bank Account Help Build Credit?

No, opening a bank account does not directly help build credit because checking and savings accounts are not reported to credit bureaus. However, responsible banking habits, such as keeping your account in good standing and avoiding overdrafts, can help you qualify for credit-building products like secured credit cards or credit-builder loans. If you’re looking for ways on how to build credit, consider using financial tools that report your payment history to the credit bureaus.

Leave a Reply